Following the GFC and a number of instances of financial malpractice, the need to understand and deal with problematic risk cultures has attracted more attention amongst the

media and regulators. Current approaches to dealing with this problem have mostly been limited to simplistic surveys and self-report processes. While a step in the right

direction these approaches consistently fall short of identifying and reducing the human related risks in the finance system.

Following more than 10 years of university-based research, Cultural Sensitivity Analysis (CSA) is a sophisticated measurement and diagnostic approach that provides insight into both the individual and social levelsof an organisation’s risk culture. Major failures of risk management usually involve the presence of multiple human-system factors (right), as it is through thecombination of these factors that defective risk cultures develop and are maintained. Our approach to risk management has been developed to assess and measure risk culture across all of these factors. Our approach includes highly targeted sampling techniques, non-gameable interview technologies and cutting edge desktop analytics to provide a detailed picture of an organisation’s risk culture. Our methodology can isolate “hot spots” where a group may demonstrate a greater risk tolerance than the organization wishes.

The human-system factors are drawn from a wide range of risk contexts, and can be combined with existing data the organization may already collect in terms of

culture and leadership surveys to develop an organization specific diagnostic.

By adopting a customized systemic approach to the analysis of risk culture it is possible to reduce the probability of major regulatory breaches and increase the performance of an organization relative to its strategic objectives.

Human-System

Factors of Risk Culture The approach is built around 5 human--system factors that lead to the realization of risk management failures:

- Stars: people within the organization who have risk appetites at odds (i.e. considerably higher) with the rest of the organization and the regulatory/compliance requirements of the industry

- Leadership: managers who form weak links within the 1st Line of defense by choosing to ignore and/or tacitly condone regulatory and compliance breaches

- High turnover in key positions: In practice, the difference between a mistake and a behavioural problem is often one of perspective. Problematic patterns of behaviour become more obvious over time. The introduction of new personnel to key positions in the management chain, means that such patterns are, for a period, invisible to the person responsible for managing them.

- Conflicting concepts of risk: The different ways in which individuals from different disciplines conceptualise and experience risk, impacts the way in which they interpret the likely impact and probability of a risk occurring. This can lead to failures of risk management, even though the people involved may have acted in a compliant way.

- Disparity in view between management and line staff: Line staff can often be a key source of knowledge in relation to business risks. Poor risk cultures display significant differences in view between management and line staff with regard to key risks in the business.

How is it delivered?

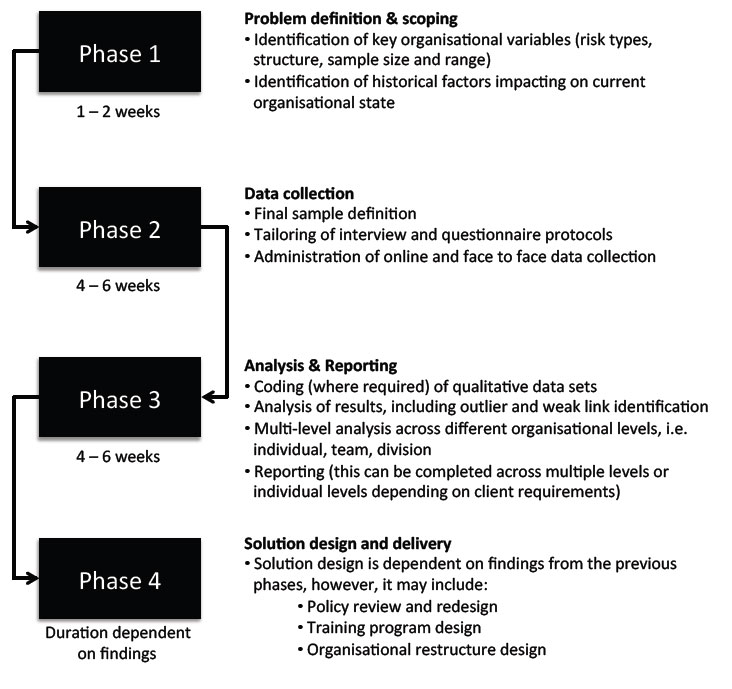

The detail of how risk culture is measured and diagnosed will differ for each organisation in order to address the unique characteristics of organisational structure and risk types addressed. However, in all cases our approach follows a broad methodology involving 4 Phases. The detail within each of these phases is tailored to suit the organisation’s needs and circumstances.

Contact:

Dr Robert Kay,

Incept Labs

rkay@inceptlabs.com.au

or

Andrew

Williamson,

The Risk Board

andreww@theriskboard.com.au